Article: The PSE black hole

-

Share This:

- Description

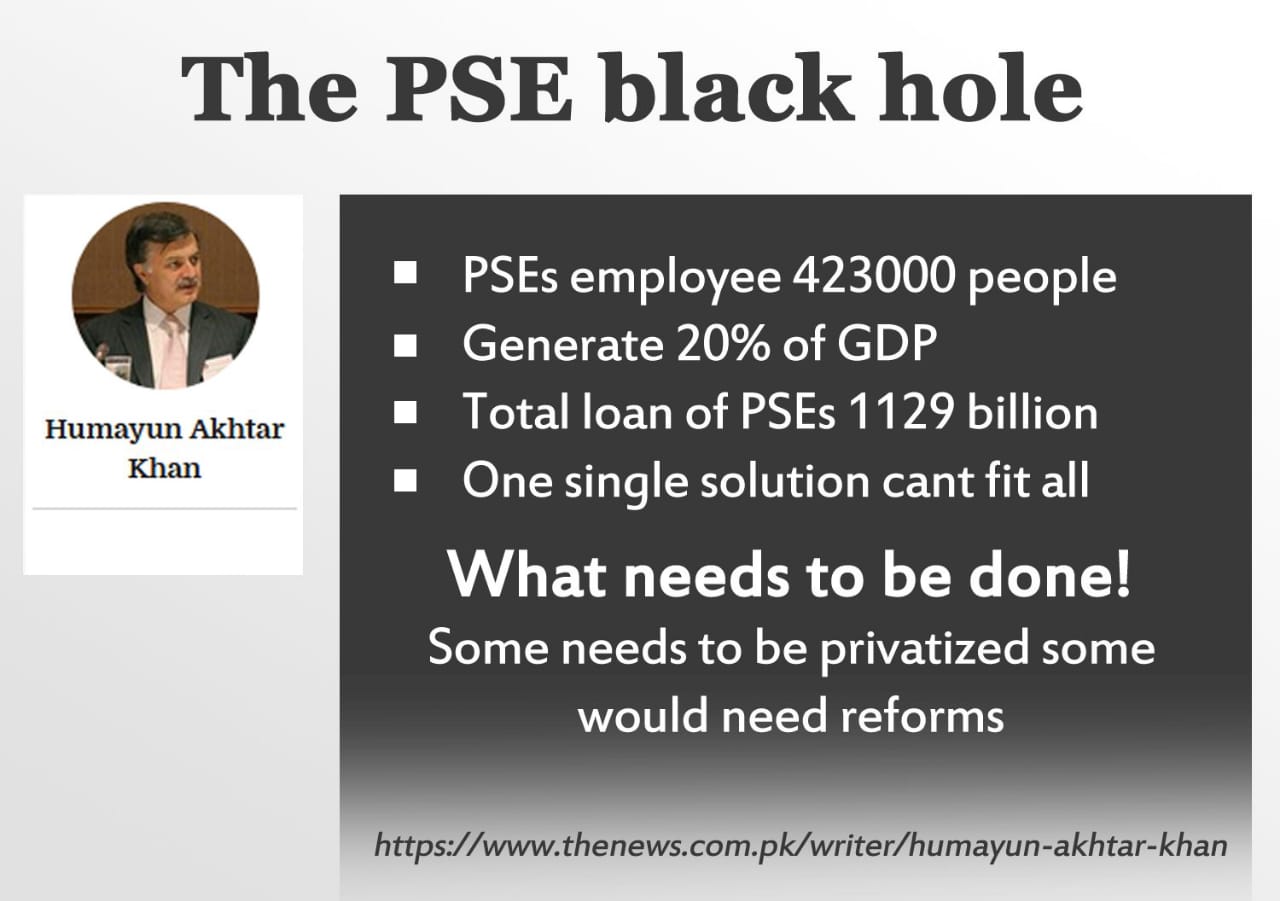

- With public finance in disarray for decades, it is only right for the government to find ways to fill the gap between revenue and spending. One source of the deficit are public-sector enterprises (PSEs), some of which have for years run large deficits. Such PSEs leak revenue, offer poor service, and rely on taxpayers to keep them afloat. Still, in order to fix them we must gain better insight. Improving PSE performance has been a stated priority of most recent governments, though nothing has been done about it. Each year, their losses seem only to have grown. Through grants and guarantees, the government has kept these companies going. Many options have been on the table to improve their performance. At various times governments have considered to reform, restructure and privatise them. Given the scale of the problem, it is critical to no longer delay action. Because of their large number and varied purposes, there is no one-size-fits-all solution for our PSEs. In fact, this is a global phenomenon, as a large number of PSEs exist worldwide, including in OECD economies. Resultantly, this is a widely studied subject with many lessons for us. In 2014, 23 percent of Fortune Global 500 firms and over 10 percent of Forbes top 2000 were state owned, some of them in the top ten. The list was skewed somewhat by Chinese firms. Data on PSEs is scarce in Pakistan. A few years ago, the finance ministry published a comprehensive report, though it has not been updated since. Because it aggregates a lot of data in one place, that report is a good place to begin an analysis. In 2014, total PSEs in Pakistan numbered 190. They employed 423,000 workers. PSEs had Rs9.6 trillion in assets and a turnover of Rs5.3 trillion that yielded Rs193.5 billion in profit. Over Rs59 billion was paid to the government as dividends. Taxes paid were in addition. On the other hand, the GoP’s stock of financial exposure is considerable. As of September 2018, its loans to PSEs stood at Rs1,129 billion. Of this, PIA alone had Rs146 billion outstanding. In 2014, the GoP paid Rs272 billion in subsidies and Rs33.5 billion in grants. The largest loss-makers were PIA, Pakistan Steel, and Pakistan Railways with losses of Rs31 billion, Rs26 billion, and Rs33 billion respectively. As a group, power distribution companies have been the most delinquent. Peshawar Electric alone had a loss of Rs34 billion that year. PSEs turnover of Rs5.3 trillion in 2014 was more than 20 percent of GDP – as much as agriculture. Given the scale, it is surprising that the GoP has had no holistic policy on how to run them. This despite repeatedly decrying their losses. The objectives for establishing PSEs vary. While they must not live off government subsidy, they do not exist for profit alone. They are set up to meet social ends or to stimulate private investment. They also come in where private capital hesitates. Often the rationale is all three. Thus, in many economies, we see utilities, mineral exploration, and national airlines in the public sector. PIA, Pakistan Railways, Wapda, and OGDCL are examples. In the past, PIDC and DFIs were critical in the country’s industrialisation. Units under the State Engineering Corporation were established to provide equipment to downstream businesses. All these organisations were provided a range of support. In addition to capital, land, grants and subsidy, the GoP has helped with access to finance, sovereign guarantees, a number of preferences, and protection from competition. With the level of support they receive, there is no reason for most PSEs to provide poor service or incur loss. Power distribution is an example. DISCOs sell a scarce good to a captive market. They are guaranteed supply of power, even when they do not pay their suppliers in full. Yet, some of them run large losses. Similarly, PIA and Pakistan Railways. Partly, it is the government’s fault; the GoP has no regulatory mechanism for managing PSEs. There is no metrics for measuring performance. There are also issues with structure. CEO powers are often usurped by the government. This diffuses CEO responsibility and restricts their space to perform. We have also not set standards for service delivery of the organisation, or ways to measure productivity. All this limits the GoP’s ability to hold CEOs accountable. Where the GoP wants to subsidise service to users, these must be quantified against agreed output. This would clarify the extent of subsidy needed for social purpose. PSEs also need fresh investment. Like the private sector, they must access quality talent and new technology. Denied these, PSEs languish and lose their purpose. DISCOs again serve as an example. They retail power worth about Rs1 trillion annually, yet are managed individually as departments. The GoP has never considered setting up a separate holding company to manage them. In the case of DISCOs, privatisation seems to be the option. For PIA, especially, it may be too late to attempt a turnaround, given the degradation in its service and performance culture. The GoP may have to write off its losses and find a strategic buyer with a track record of high performance. Its landing rights in many world airports should attract interest. However, mismanaged PSEs are hard to privatise. They have large liabilities, negative capital and poor ratios. This is where government’s plans for the Sarmaya holding company should help. Some PSEs must just close down. International practices show that developing economies have low capacity for privatising successfully. Even in OECD economies, privatisation has had little effect on productivity. Pakistan’s experience is mixed. So, for it to succeed, privatisation should be done well. Before privatising we must make clear its goals and outcomes. The process must be open and transparent, and the privatised entity must work in a competitive space. The government must issue regulations for their operation. And we must avoid elite capture. The writer was commerce minister in 2002-2007. He is chair and CEO, Institute for Policy Reforms. The writer was commerce minister from 2002 till 2007. He is chair and CEO of the Institute for Policy Reforms.

- Updated:

- 2/6/2019 12:00:00 AM